- Up to 70% Financing Loan to Value*

- All Types of Credit Considered

- Starting at $25,000

- LOW Monthly Payments You Can Afford

REPAIR FINANCING CALCULATOR

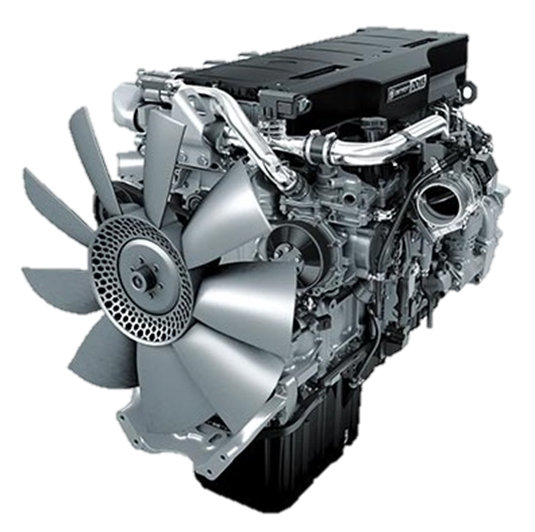

A breakdown or engine failure can happen at any time. Fortunately, funds are available to get you back on the road, yard or to the middle of nowhere. It has never been easier to finance major repairs.

*OAC – Terms and payments may vary based on credit, age of equipment, mileage, time in business and loan to value.

**Payment – Lien and Repair will be consolidated as one new contract OAC.

Step 1 of 2

FILL OUT THE FORM

TO GET A PAYMENT

How it works:

Fast Credit Approvals so you can decide what works best for you.

Know your max approval going into a repair or replacement.

Get and sign your Documents Via Email

We pay the shop when its done and you pick it up.

Frequently Asked Questions

Will there be a lien placed on my equipment?

With this program yes, the lender requires a first charge on the equipment which means any other liens or charges must be paid out as well and consolidated into one new finance. The benefit is that it creates one simple and lower payment for the customer overall. We will do much of the background work to make this as easy as possible.

Can I pay the financing out at any time?

The contract can be paid out early with the balance of payments owing. There are no exit penalties and often discounts can be applied. This is very similar to how most non-bank equipment leases and loans work. Many of the repair financing contracts are structured as leases giving the customer an enhanced tax benefit with more stability than bank financing.

What is the interest rate?

One great feature of this financing program is there is not one credit box every customer needs to fit into. Established business through to start ups all have options for financing at competitive rates based on credit, age of equipment and the amount borrowed. Rates and terms are disclosed in advance with no obligation or cost to you should you chose other options.

What are the financing program terms?

The maximum financing is 70% of the post repaired market value. Repayment terms range from 24 to 48 months. The minimum application currently is $25,000 plus tax. Age of equipment is subject to mileage/hours and credit of borrower. If you have a payment or structure you’d like to see don’t hesitate to ask!

The Patron West Advantage:

POTENTIAL

Grow your business on your terms and with more buying power.

RATES

We fight for the best rates so you can save cash and lower payments.

SERVICE

Canada wide specialists to help you with your business needs.

LIEN EXAMPLE

Fair Market Value of repaired Equipment $60,000

Lien to existing lender $10,000

Max 70% to advance repairs less liens = $32,000

FREE AND CLEAR EXAMPLE

Fair Market Value of repaired Equipment $60,000

Max 70% to advance repairs = $42,000